how to check unemployment tax refund amount

Once you submit your application we will. One check two checks or a check and a direct.

Unemployment Tax Break Refund How To Check Your Irs Transcript For Clues

Numbers in Mailing Address Up to 6 numbers.

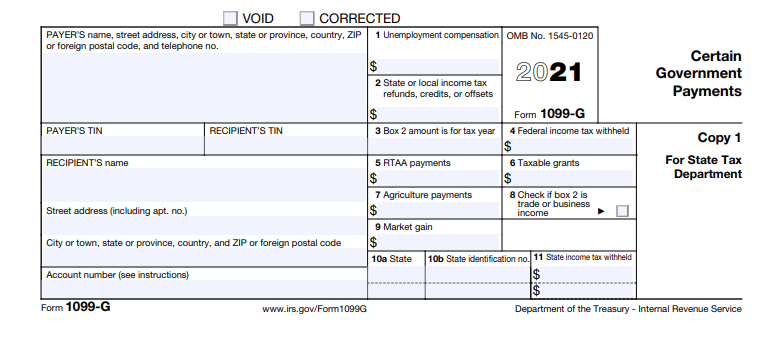

. Numbers in your mailing address. If you see a 0. In Box 1 you will see the total amount of unemployment benefits you received.

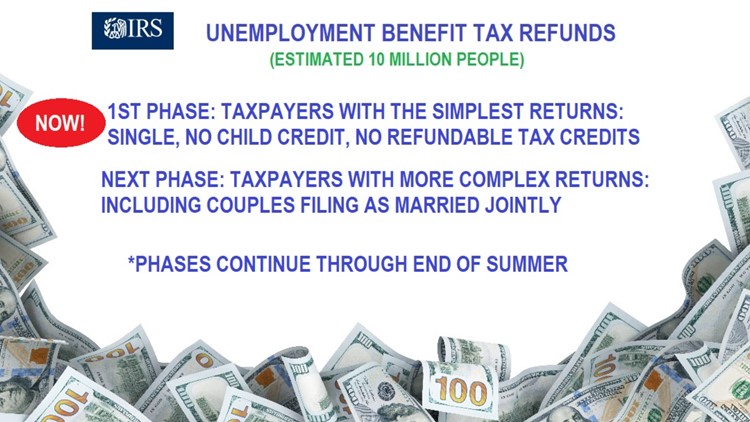

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. Parents can also look out for extra money with the next advance child tax credit payment being sent this Friday Aug. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form.

IRS sending unemployment tax refund checks For most states you will receive Form 1099-G in the mail from your state unemployment office. And then the first refund check including interest for the delay in processing compare this with your tax return followed by the second refund. IRS sending unemployment tax refund checks Use the Wheres My Refund tool or the IRS2Go mobile app to check your refund online.

In Box 4 you will see the amount of federal income tax that was withheld. However the exclusion could result in an overpayment refund of the tax paid on the amount of excluded unemployment. Check Your 2021 Refund Status.

Review and change your withholding status by logging onto Unemployment Benefits Services and selecting IRS Tax Information from the Quick Links menu on the My. Find out how you can obtain. This is the fastest and easiest way to track.

The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount which can range from 40 to 450 per week. By November 1st eligible residents should get refund checks for up to 325. Viewing your tax records online is a quick way to determine if the IRS processed your refund.

2 days agoThe first checks and direct deposits from 3 billion in excess tax revenue will head back to Massachusetts taxpayers starting Tuesday when the calendar officially changes to. The systems are updated once every 24 hours. If your mailing address is 1234 Main Street the numbers are 1234.

Income tax refund checks of up to 800 will be sent out to South Carolina taxpayers starting in late November or December. The maximum award for joint filers is 650. If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next.

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. If none leave blank. The IRS is expected to continue working through the tax.

If you move without notifying. This is the fourth round of refunds related to the unemployment compensation. 1 Massachusetts started issuing one-time tax refunds to residents via checks and direct deposits.

According to the state Department of Revenue roughly 3 million. To report unemployment compensation on your 2021 tax return. If an adjustment was made to your Form 1099G it will not be available online.

In the meantime well show you how to look for clues on your tax. Form 1099G tax information is available for up to five years through UI Online. How long it normally takes to receive a refund.

The 310 code simply identifies the transaction as a refund from a filed tax return in the form of an electronic payment. The easiest way to do this is by figuring out your taxable income by not adding the unemployment compensation exclusion youre eligible for and then tax liability. Any resident who paid taxes will receive a.

Social Security Number 9 numbers no dashes. Check For the Latest Updates and Resources Throughout The Tax Season. Your exact refund amount.

Using the IRS Wheres My Refund tool Viewing your IRS account information.

Freetaxusa Federal State Income Tax Calculator Estimate Your Irs Refund Or Taxes Owed

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com

Are Unemployment Benefits Taxable Wcnc Com

Irs Unemployment Refunds Moneyunder30

Accessing Your 1099 G Sc Department Of Employment And Workforce

Tax Refund Irs Says 2 8m Will Get Overpaid Unemployment Money Returned This Week Kxan Austin

Unemployment Refund Notice Received 2 Months Ago Still No Check R Irs

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

Here S How To Track Your Unemployment Tax Refund From The Irs The Us Sun

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

Did You Get Unemployment In 2020 You Could See A Tax Refund Soon Wfmynews2 Com

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

Here S How To Get Your Unemployment Tax Refund Irs Says Payments Coming In May Silive Com

File For Unemployment In Arkansas In 2020 You Could Get A Refund Thv11 Com

Irs Refund 4 Million Tax Refunds For Unemployment Compensation Marca

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor